cryptocurrency tax calculator canada

Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity. The CRA says Capital gains from the sale of.

How To Calculate Cryptocurrency Taxes Using A Crypto Tax Calculator Zenledger

Coinpanda is the worlds most easy-to-use cryptocurrency portfolio tracker and tax software.

. Cryptocurrency Tax Calculator. Our platform allows you to import transactions from more than 450 exchanges and. Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance.

To work cryptocurrencies rely on a sort of. Cryptocurrency is a type of digital currency or payment that may be used to buy and sell goods and services on various online platforms. Establishing whether or not your transactions are.

But other actions such as gifting selling or using cryptocurrency to make purchases can have tax. However it is important to note that only 50 of your capital gains are taxable. Create your free account now.

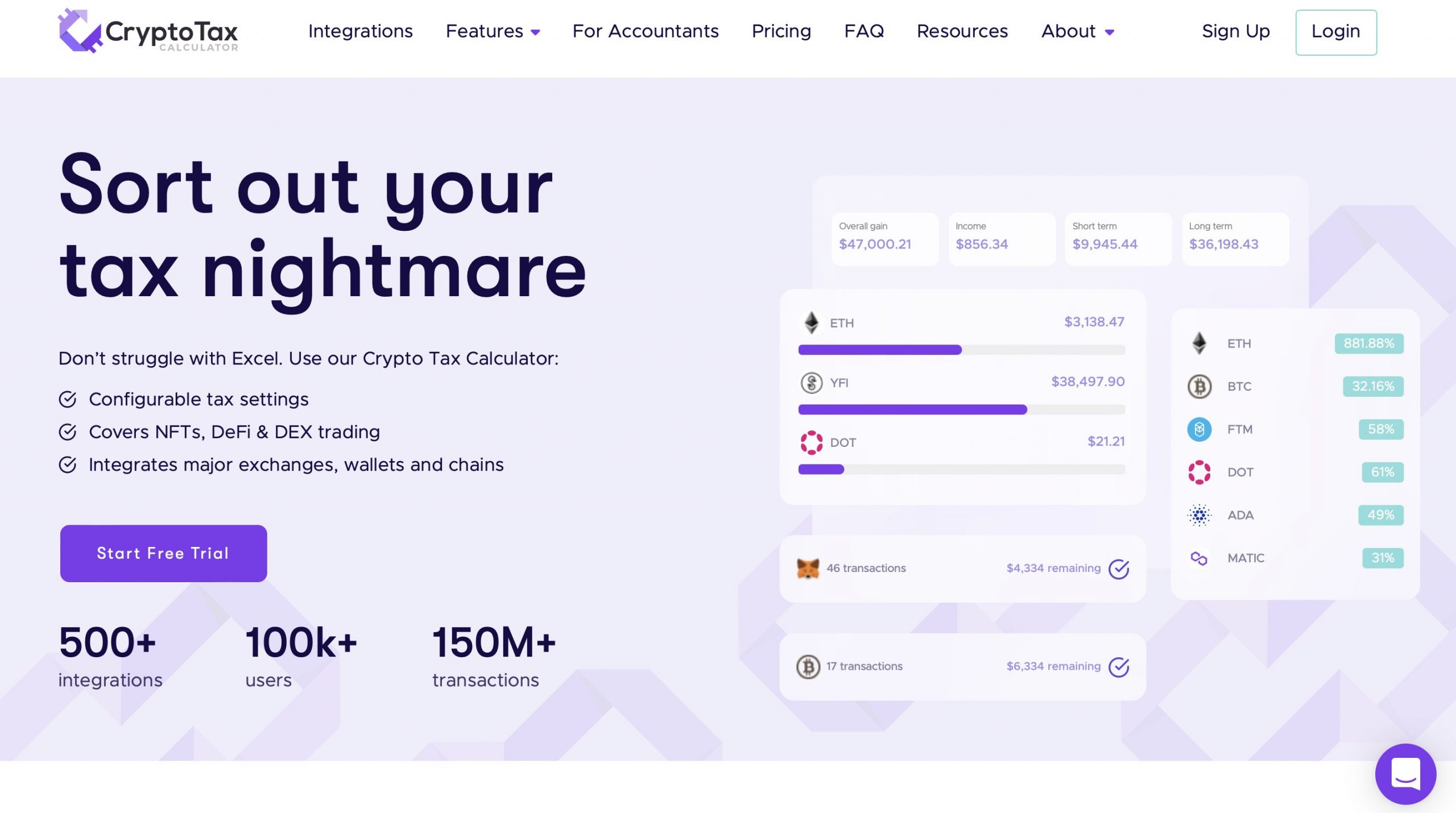

For GSTHST purposes if your. According to the CRA possession of a cryptocurrency does not require you to file taxes. Crypto Tax Calculator.

Crypto Taxes for Canadians learn taxpayer responsibility for Bitcoin and cryptocurrency investors how to keep records and calculate gain and loss for tax purposes. Bitcoin Tax Calculator for Canada. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income.

To help you with your tax planning for tax year 2021 you can also find out if you have a capital gain or loss and compare your tax outcome of a short term versus long term. However it is important to note that only 50 of your capital gains are taxable. Tax-Loss Harvesting With A Crypto Tax Calculator In general terms losses resulting from cryptocurrency trades are tallied against any gains.

Calculate your crypto taxes and learn how you can minimize crypto taxes for the USA UK Canada and Australia. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity. How To Calculate Your Crypto Tax In Canada If your crypto disposal is treated as a capital gain half of your gain will be subject to tax.

The Senate reviewed the issue of. The Canada Revenue Agency CRA treats cryptocurrency as a property taxed either as business income or capital gains. You simply import all your transaction history and export your report.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. February 12 2022 by haruinvest. Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations.

As such you must declare your earnings on your tax return. You will need to calculate the value of your cryptocurrency to file your tax return. In this complete tax guide we will explain everything you need to know about how crypto taxes work in Canada including breaking down the latest tax guide from the CRA how.

10 to 37 in 2022 depending on your federal. This means you can get your books. It takes less than a minute to sign up.

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax Calculator Ey Us

Cryptocurrency Tax Guides Help Koinly

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Cryptocurrency Taxation In Canada In 2022 Cryptocurrency Capital Assets Goods And Services

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Github Davidosborn Crypto Tax Calculator A Tool To Calculate The Capital Gains Of Cryptocurrency Assets For Canadian Taxes

11 Best Crypto Tax Calculators To Check Out

Crypto Taxation In Canada 2022 Ultimate Guide Ocryptocanada

Top 8 Crypto Tax Software Alternatives To Cointracking Updated 2021 Coincodex

11 Best Crypto Tax Calculators To Check Out

11 Best Crypto Tax Calculators To Check Out

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

Cryptocurrency Tax Calculator Forbes Advisor

How To Calculate Crypto Taxes Koinly

11 Best Crypto Tax Calculators To Check Out

Best Crypto Tax Software Top Solutions For 2022