ct sales tax registration

Our new registration application is clear simple and step-based. Youll be asked to file and pay sales tax either monthly quarterly or.

Credit Applications Tarantin Industries

Page 1 of 1.

. Now you can file tax returns make payments and view your filing history in one location. Department of Revenue Services. Using Back Button of the browser that is not.

New Connecticut residents arent required to pay sales tax if the vehicle was registered in the same name in another state for at least 30 days prior to establishing Connecticut residency. LoginAsk is here to help you access Ct Sales Tax Registration quickly and handle each specific. Up to 10 cash back Common types of taxes you may need to register for.

A corporation employing people in states with an income tax must withhold this tax from their. Either your session has timed-out or you have performed a navigation operation Ex. Rental Surcharge Annual Report.

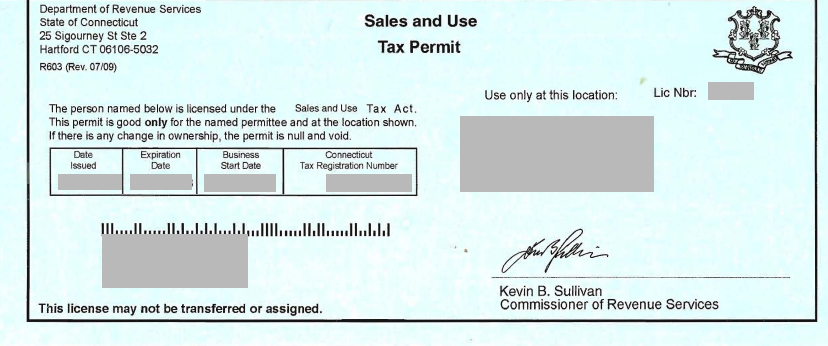

If you have questions about the sales tax permit the Connecticut Department of Revenue Services has a guide to sales taxes in Connecticut or can be contacted by calling 800. Connecticut Department of Revenue Services - Time Out. Only the Connecticut Department of Revenue Services can issue Connecticut tax registration numbers for sales tax withholding.

The current sales tax in Connecticut is 635 for vehicles that are 50000 or less. Department of Revenue Services State of Connecticut. This means that if you purchase a new vehicle in Connecticut then you will have to pay an.

Business use tax is due when a business purchases taxable goods or services. GENERAL INFORMATION ABOUT TAX SALES. Please do not call the municipality or its attorney with questions about tax sale properties or procedures until after you have thoroughly reviewed.

This tool can be used on any vehicle purchased from a dealer. IMPORTANT INFORMATION - the following tax types are now available in myconneCT. You will receive your CT Registration Number in real time.

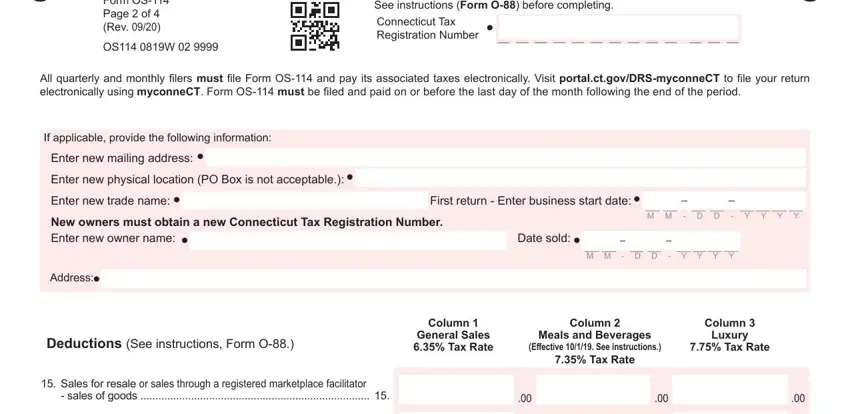

MyconneCT is the new online hub for business tax needs. When to file taxes in Connecticut. When you register for sales tax Connecticut will assign you a certain filing frequency.

Individual Income Tax Attorney Occupational Tax Unified Gift and. Visit myconneCT now to file pay and. Business use tax is due when a business purchases taxable goods or services.

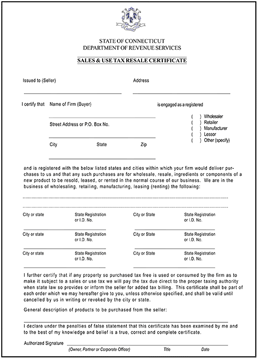

If you are registered for or are registering for sales and use taxes you do not need to complete this section. Fill out form REG-1 and remit it along with a check for Connecticuts sales tax permit application fee of 100 to. Health Care Provider User Fees.

New Business Registration is now available in myconneCT. Sale of computer and data processing services. A tax at the general rate of 635 is imposed by the state on most sales of tangible personal property and on most services enumerated in Section 12-407 of the Connecticut General.

While the general sales and use tax rate is 635 other rates are imposed under Connecticut law as follows. If you are registered for or are registering for sales and use taxes you do not need to complete this section. Dry Cleaning Establishment Form.

Ct Sales Tax Registration will sometimes glitch and take you a long time to try different solutions. 800 524-1620 Connecticut State Sales Tax Online. Online Registration Application - Connecticut.

The sales tax calculator should be used on every out-of-state dealer transaction.

Ct Form Os 114 Fill Out Printable Pdf Forms Online

Synmac Consultants Company Registration Consultants Service Tax Sales Tax Tin Vat Return Fillings Firm Regi Cost Accounting Inventory Accounting Company

Free Connecticut Vehicle Vessel Bill Of Sale Form H 31 Pdf Eforms

How To File And Pay Sales Tax In Connecticut Taxvalet

State By State Guide To Economic Nexus Laws

Connecticut Tow Operators Aren T Concerned About Malloy S Proposed Tax Changes

Mass Ct Tax Structures Come Under Spotlight Hartford Business Journal

State Cuts Sales Tax Permit Period To Two Years Cbia

Connecticut U S Small Business Administration

How To Form An Llc In Connecticut For 49 Ct Llc Registration Zenbusiness Inc

Connecticut Sales Tax Filing Update December 2018 Taxjar Support

Connecticut Sales Tax Quick Reference Guide Avalara

Car Tax By State Usa Manual Car Sales Tax Calculator

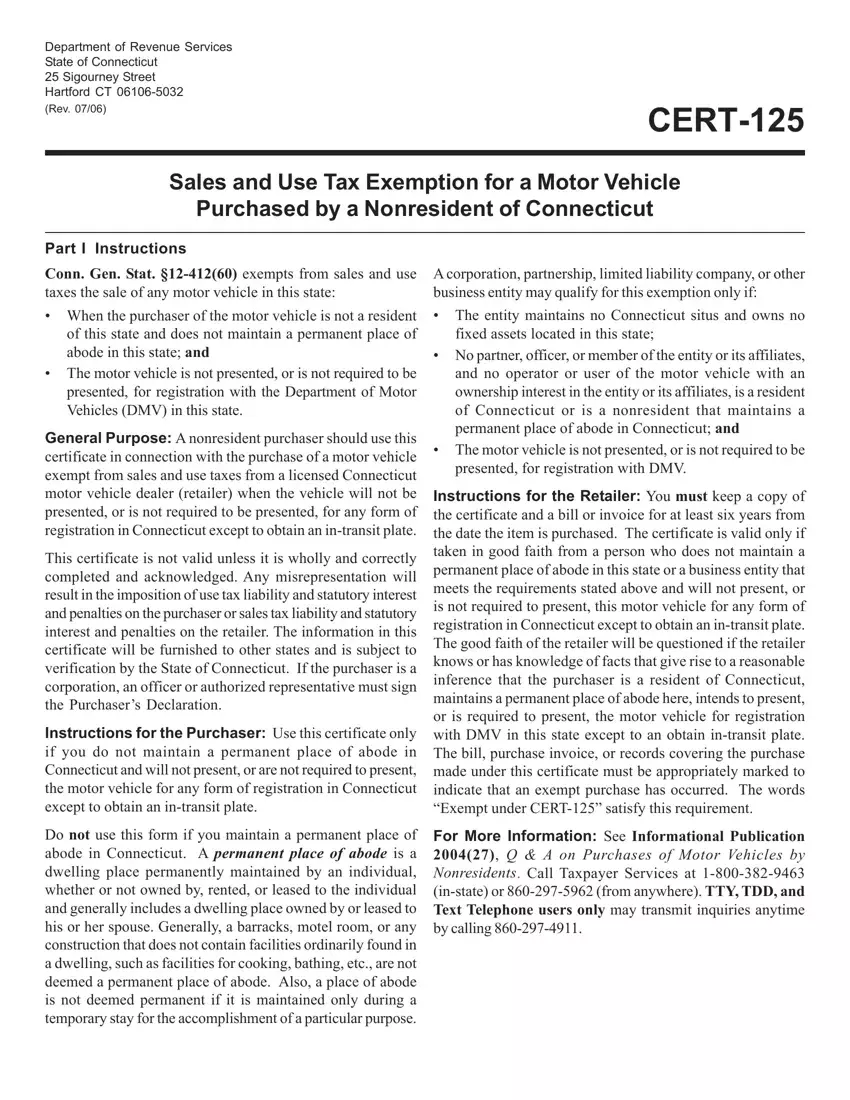

Cert 125 Fill Out Printable Pdf Forms Online

Dmv Registration Ct Form Fill Out And Sign Printable Pdf Template Signnow

Connecticut Department Of Revenue Services

The Connecticut Poll Tax Connecticut History A Cthumanities Project

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars